Flexible capital

Days

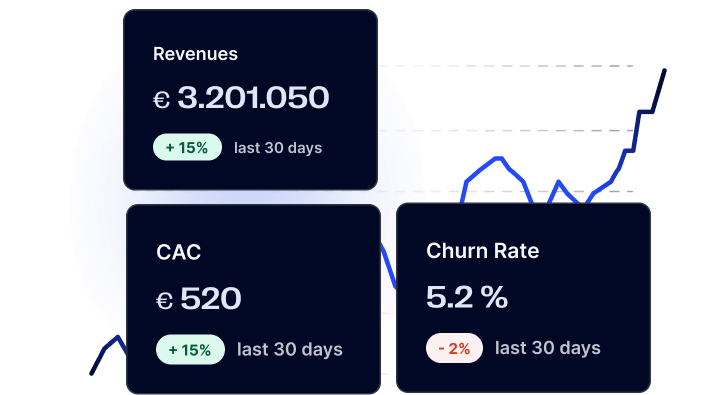

Predictive Analytics

Fund your digital journey

Get flexible growth capital from €10k to €5mln for your digital business in three days

To be eligible for funding, you need…

![]() More than 6 months of online sales

More than 6 months of online sales

![]() Online marketing budget above 10,000€

Online marketing budget above 10,000€

![]() Monthly revenues equal to/above 10,000€

Monthly revenues equal to/above 10,000€

How does the funding process work?

Viceversa prides itself on being completely transparent in helping you access capital. Our internal algorithm adapts offers based on your business needs and historical data.

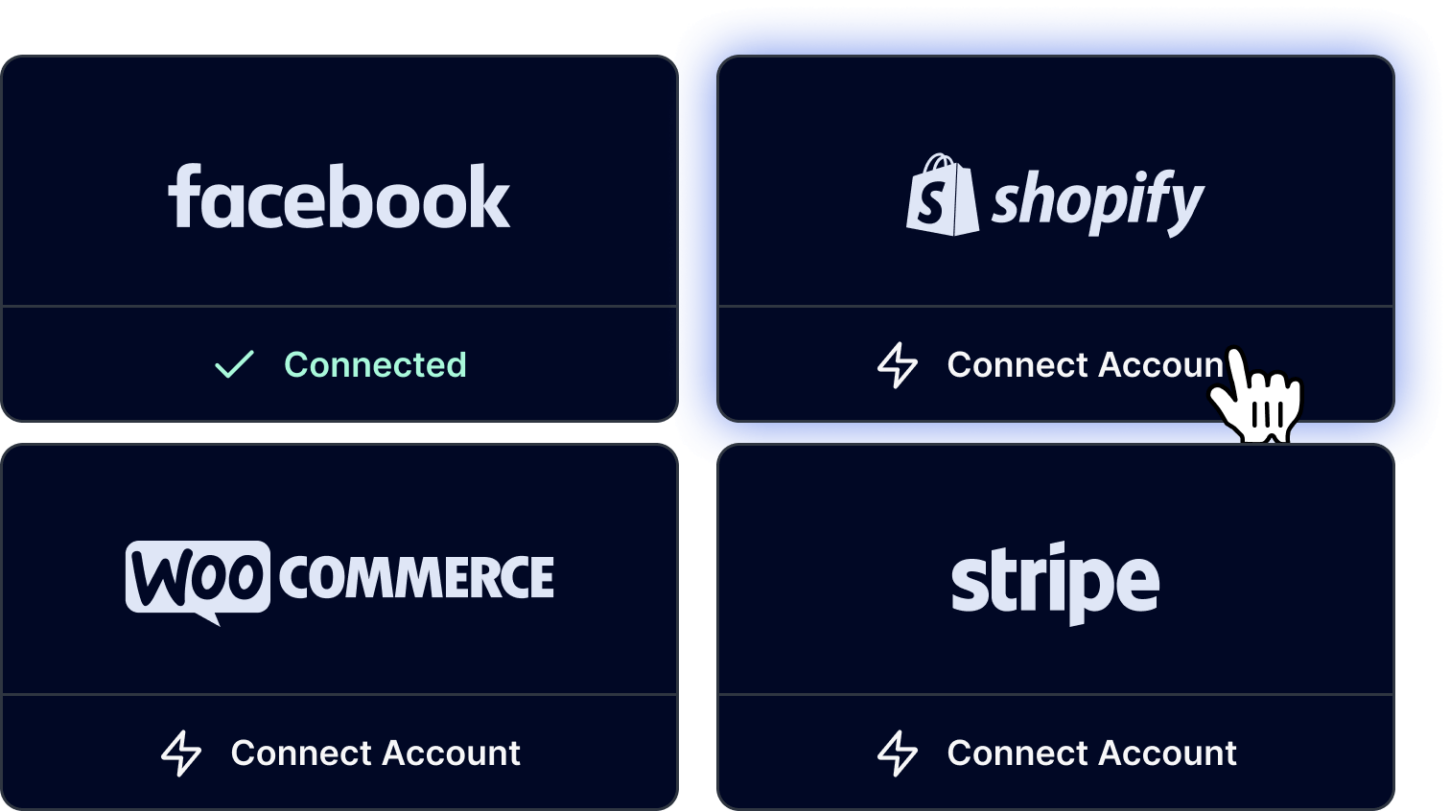

Register and connect your accounts

Register on the Viceversa growth platform and securely connect your business and accounts. Find out if you’re eligible for funding right away.

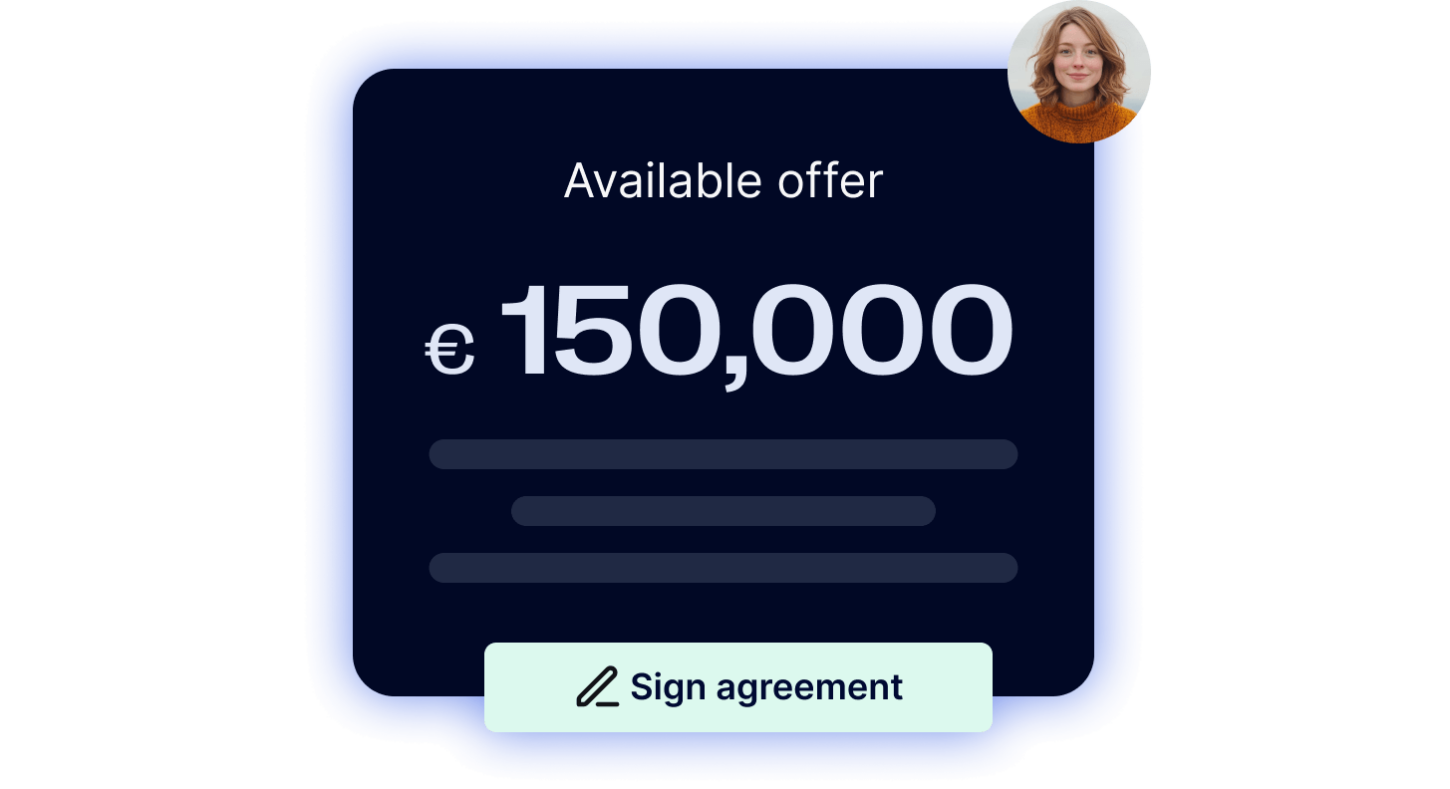

Accept your tailored offer

Receive your funding offers within 3 days. Choose one that suits your business the best. Access funds on your virtual card as soon as you sign the contract.

Boost your growth

Invest in marketing campaigns, inventory, or offer free shipping. Use our data-driven analytics platform to make better (no, the best) decisions.

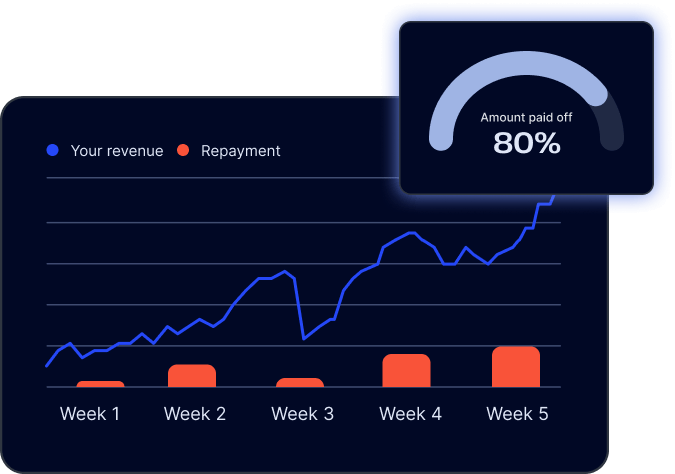

Pay as you grow

Pay a small percentage of revenues, with no hidden fees or due dates. We’re a partner in your good times and bad.

Get StartedHow much growth capital can you get?

![]() Enter your monthly revenue into our handy RBF tool

Enter your monthly revenue into our handy RBF tool![]() Discover potential growth capital and repayment options

Discover potential growth capital and repayment options![]() Tailored for you

Tailored for you

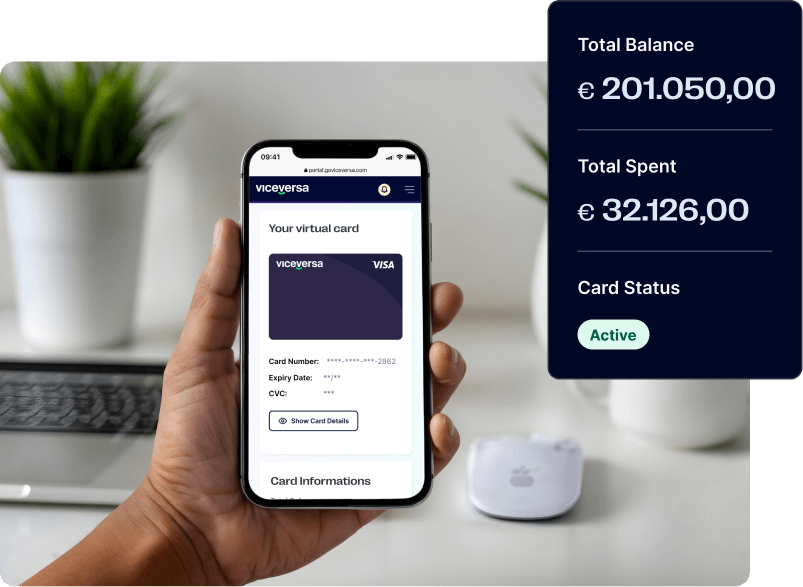

Viceversa’s virtual card eases payments

Get the most out of your digital marketing budget with a card that offers complete oversight and easy access to your approved growth capital, with the trusted security of Stripe

![]() Simple, no cost & automatic

Simple, no cost & automatic![]() Streamlined expense management

Streamlined expense management![]() Increased flexibility

Increased flexibility![]() Increased security

Increased security![]() Improved cash flow

Improved cash flow![]() Complete control

Complete control

Frequently asked questions

Your data is safe with us

When you connect your marketing and ad accounts to our analytics platform, we use that data to populate the dashboard and calculate marketing KPIs.

Your data is completely encrypted.

Viceversa newsroom

Read the latest press coverage, media mentions, partnership announcements, product updates and more.

Refer a digital business.

Earn a bonus.

Do you know a growing startup, cool SaaS company, subscription-based service or other digital business looking for capital?

Send them our way and earn a bonus!