Revenues

June vs. May 2025

Platform subscriptions

July vs. May 2025

Average time to convert (Q3 vs Q2)

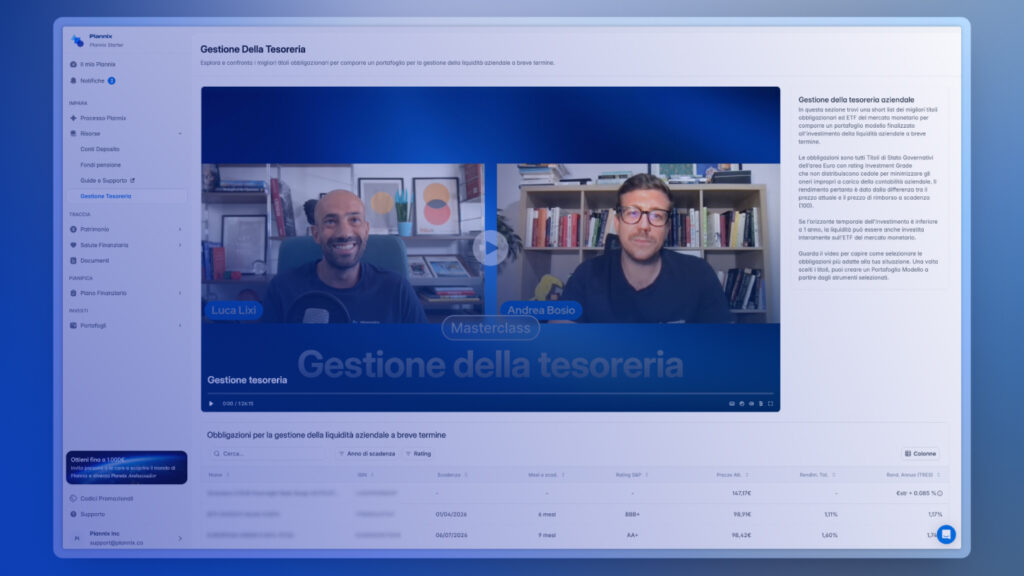

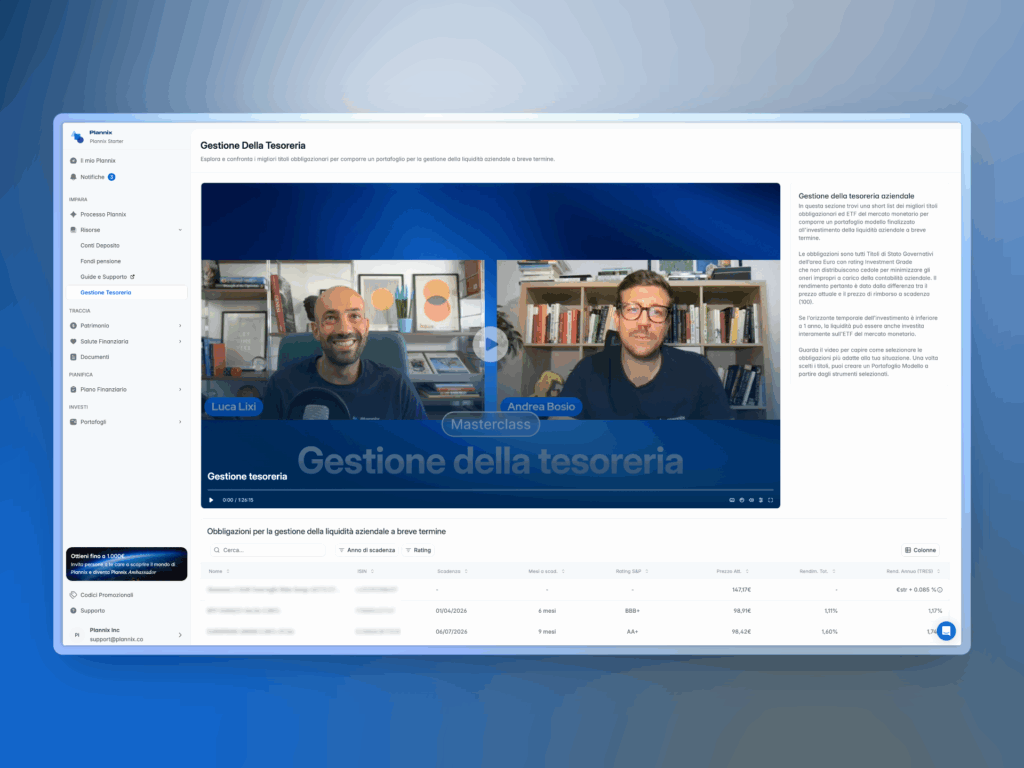

Luca Lixi, CEO and founder of Plannix, created the company with a clear mission: to help individual investors and their families manage their finances and invest effectively, steering clear of the unnecessary costs and conflicts of interest common in the traditional financial world. After raising $500k pre-seed from angel investors (founders, second-generation entrepreneurs, executives in finance and technology), Plannix continues to combine unbiased education, a proprietary in-house platform, and expert financial advice to serve its B2C audience of affluent savers and investors.

Challenge

After successfully validating its business model and beta-testing its technology, Plannix was ready to scale its customer base. The leadership team preferred to allocate its equity fundraising to the continued development of its core technology product. This created a strategic challenge: how to finance its go-to-market initiatives, such as testing new advertising channels and marketing strategies, without tapping into its equity capital.

Plannix needed a financing solution that was flexible enough to support experimental growth strategies.

As a startup, we are in fact constantly testing new advertising and marketing investments that, like any investment, do not have a certain ROI.

Specifically, Plannix aimed to target a key demographic: entrepreneurs. This required more than just a new ad campaign. It meant developing a dedicated feature on their platform to help entrepreneurs manage and invest their corporate cash, turning it from a stagnant liability into a productive asset. This dual need for marketing spend and product development required a smart, non-dilutive funding approach.

Solution

Plannix found the perfect partner in Viceversa. Revenue-based financing offered the flexibility and speed that traditional financing couldn’t match. This innovative funding model allowed Plannix to:

- Preserve equity: By using RBF for go-to-market strategies, Plannix could reserve its valuable equity capital for long-term technology development.

- Accelerate growth initiatives: The capital from Viceversa was quickly deployed to fund new advertising channels, sponsorships, and joint ventures that had been on the back burner.

- Test and iterate freely: The flexible repayment structure, tied directly to revenue, gave Plannix the freedom to test new campaigns and product features without the pressure of fixed monthly loan payments.

Viceversa provided the capital needed to turn Plannix’s strategic ideas into concrete results, empowering the company to approach its growth initiatives with greater serenity and focus.

Strategy

With the capital from Viceversa, Plannix executed a targeted strategy to attract and convert a high-value customer segment: entrepreneurs. This involved both short-term marketing pushes and long-term product enhancements.

Short-term Strategy

Targeted Marketing Campaign: Plannix invested a significant portion of the funding into advertising and sponsorships designed to reach entrepreneurs. The core of this initiative was a campaign focused on a topic of strong interest: managing personal and corporate cash.

The campaign included:

- A 3-Day Workshop: An online event dedicated to the specific financial challenges faced by entrepreneurs, attracting a qualified and engaged audience.

- A Dedicated Offer: Plannix created a special package that combined its core financial advisory service with specific tools for controlling and optimizing corporate liquidity.

This targeted approach generated immediate results by engaging entrepreneurs with greater investment capacity and shortening the decision-making process, thanks to the high perceived value of the offer.

Long-term Strategy

Product Resources: The funding also supported the growth of the product team, enabling the development of a new platform feature. This functionality guides entrepreneurs in investing their corporate cash, transforming it into a productive asset rather than letting it lose value to inflation. This long-term enhancement created a unique selling proposition and deepened the value Plannix offers to its target market.

Results

The partnership with Viceversa enabled Plannix to achieve impressive and measurable growth in a short period. The campaign targeting entrepreneurs, launched in June 2025, produced remarkable results:

- Sales from new entrepreneur customers grew by 65% in June compared to May 2025.

- July 2025 saw record sales of the Plannix plan for entrepreneurs, a 53% increase in subscriptions compared to the month before the campaign.

- Mid-year Annual Recurring Revenue (ARR) saw a +30% increase QoQ, confirming a solid growth trend.

- The average time to convert was dramatically reduced by 822% Q3 vs Q2 due to the focus on a high-spending target audience.

These metrics demonstrate how Viceversa’s flexible capital allowed Plannix not only to launch a successful marketing campaign but also to translate it into sustained business growth.

Why Viceversa?

Plannix’s success story illustrates how revenue-based financing can be a powerful tool for SaaS businesses looking to scale without diluting equity. By strategically separating funding sources—equity for product and RBF for go-to-market—Plannix accelerated its growth and solidified its position in the market.

I consider Viceversa to be a solid and transparent partner for capital needs for business growth: simple processes, quick turnaround time, and little red tape. I appreciated the clarity in terms and the team’s willingness to advise on the best solutions. Concrete support in turning ideas into results.

Register for our growth platform here.

Similar stories

We are proud to share stories of our open network of entrepreneurs who have used Viceversa’s funding to grow their digital businesses.

Want to save 57 days a year?

2 out of 3 businesses spend about 60 days a year only pitching for and accessing funds*. With Viceversa, you do it in 3.

*Source