Financial management in business is often tedious but critical for growth. CEOs and CFOs are increasingly adopting digital solutions to streamline operations, minimize costs, and make informed decisions. Whether you’re overseeing budgets, managing payroll, or forecasting cash flow, accessing the right tools can be a game-changer.

This article introduces top free financial tools tailored for CEOs, CFOs, and financial managers, providing expert insights into their features, benefits, and real-world applications.

Understanding the Importance of Financial Tools

Fractional CFOs and consultants are leveraging free financial tools to build AI-powered fintech stacks for greater efficiency and accuracy in business decision-making. These tools allow you to centralize financial data, automate routine tasks, and provide a precise understanding of your company’s performance. They’re particularly valuable for small startups and organizations aiming to optimize costs while maintaining excellence in financial processes.

If you’re looking for premium-level insights without breaking the bank, these free financial tools can help you manage cash flow, execute payroll, budget smarter, and analyze data effectively. Here’s a curated list of exceptional free solutions for professionals like you.

Top Free Financial Tools for CEOs and CFOs

1. Cube

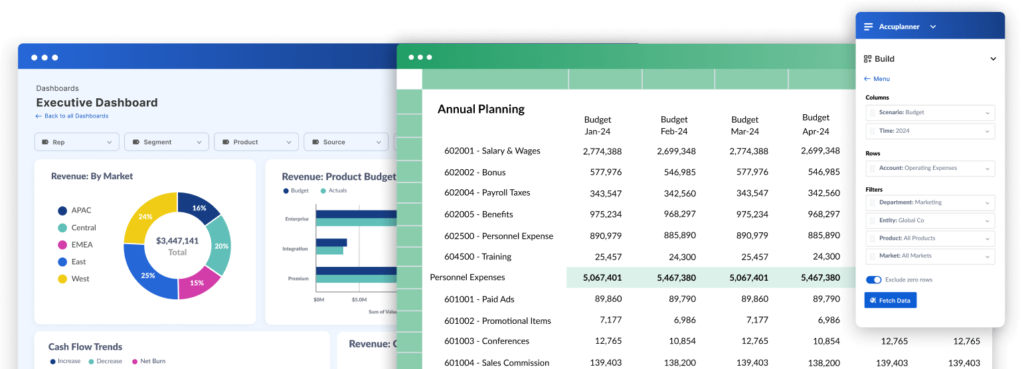

Cube is the FP&A software that makes financial planning, analysis, and reporting feel refreshingly simple. It connects seamlessly with the systems you already rely on—like your ERP, HRIS, and CRM—so everything works together smoothly. No more jumping between platforms or dealing with clunky tools; this platform lets finance teams work right in Excel and Google Sheets, keeping your financial data in one reliable, easily accessible place. Say goodbye to the usual FP&A headaches and hello to a smoother, smarter process.

Designed with finance teams in mind, Cube combines powerful integration with a user-friendly interface, allowing for effortless report generation and collaboration. Dive into strategic insights without the usual friction, and enjoy the freedom to focus on what really matters: driving impactful financial decisions.

Features:

- Direct integration with ERP, HRIS, and CRM systems

- Advanced analytics for scenario modeling and planning

- Real-time static report generation

- Collaborative capabilities in Excel, Google Sheets, or Cube itself

- Centralized data management for clear financial insights

Pricing: Limited free trial; advanced access is paid.

Try Cube

2. Zoho Books

Zoho Books is a dynamic, cloud-based accounting platform crafted for businesses of all sizes. For small and growing companies, the free plan provides an effortless way to manage invoices, expenses, and banking—all at no cost. For larger organizations ready to level up, affordable paid plans unlock powerful features like advanced inventory management, forecasting, and detailed reporting.

Perfect for digital-first businesses, this is one of those free financial tools that brings seamless expense tracking and sharp financial insights to the table, letting you take control without stretching the budget.

Features:

- Automated bank reconciliation and expense management

- Comprehensive invoicing and payment processing

- Insightful financial reporting tools

- Customizable dashboard for real-time financial visibility

Pricing: Free for small businesses; advanced functionalities are part of paid plans.

Try Zoho Books

3. PULSE

PULSE is the ultimate AI-powered financial intelligence tool, crafted for CEOs, CFOs, and ambitious finance teams ready to transform their financial strategy. This isn’t just another planner—it’s a powerhouse of predictive AI and advanced business analytics that redefines what’s possible in forecasting, budgeting, and strategic planning.

Built for precision and speed, PULSE integrates effortlessly with your existing systems, allowing finance leaders to dive deep into unit economics and cash flow with unmatched accuracy. Its intuitive dashboards and vivid visualizations put the information you need right at your fingertips, empowering real-time, proactive decision-making. With PULSE, finance professionals don’t just see the future—they shape it, driving better financial outcomes and setting the stage for sustained success.

Features:

- Predictive AI for advanced financial forecasting

- Customizable dashboards and business analytics

- Real-time insights for growth-focused decision-making

- Data centralization for clearer financial analysis

Pricing: Open for beta and available for free to demo customers for a limited time

Try PULSE

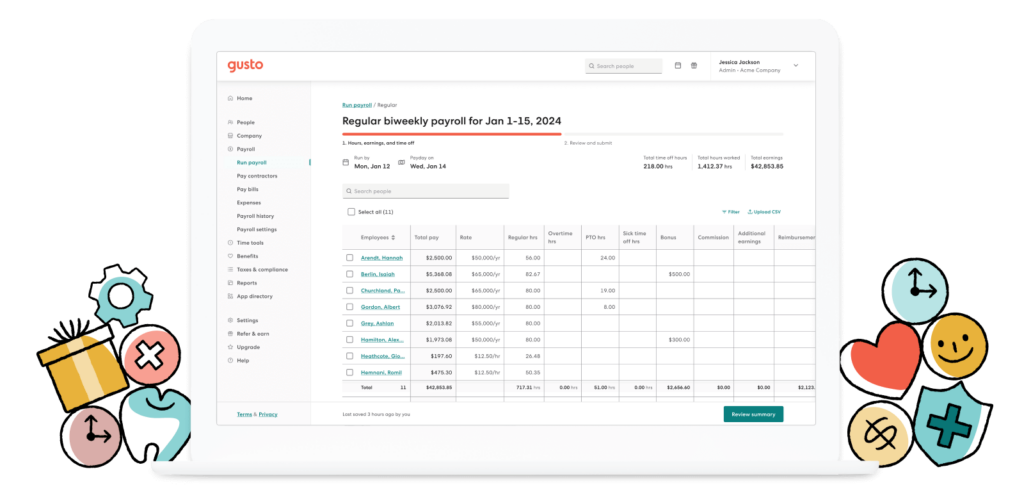

4. Gusto

Gusto brings payroll and employee management to a new level, crafted especially for small and mid-sized businesses. Its free tier offers essential payroll processing, giving smaller finance teams a cost-effective way to streamline workforce management. As businesses grow, Gusto’s premium options unlock powerful features like benefits administration, tax filings, and compliance support—helping companies stay on top of their game as they scale.

Features:

- Simple payroll processing

- Direct deposit and tax form generation

- Integration with accounting tools for streamlined processes

- Option to scale with additional HR features

Pricing: Free for basic features; premium HR features require payment.

Try Gusto

5. Wave

Wave is a no-cost, no-strings-attached accounting software tailored for small businesses looking to streamline their finances. CFOs and finance teams can easily manage cash flow, invoicing, and payments without spending a dime on subscriptions. Ideal for businesses seeking a hassle-free, intuitive platform, this tool keeps you on top of accounts and revenue trends, making financial oversight both easy and budget-friendly.

Features:

- Comprehensive invoicing and payment tracking

- Dashboard for expense management and profit visibility

- Payroll and tax filing add-ons for expanding teams

- Real-time cash flow analysis

Pricing: Free for accounting and invoicing; charges apply for payroll and credit card processing.

Try Wave

6. Expensify

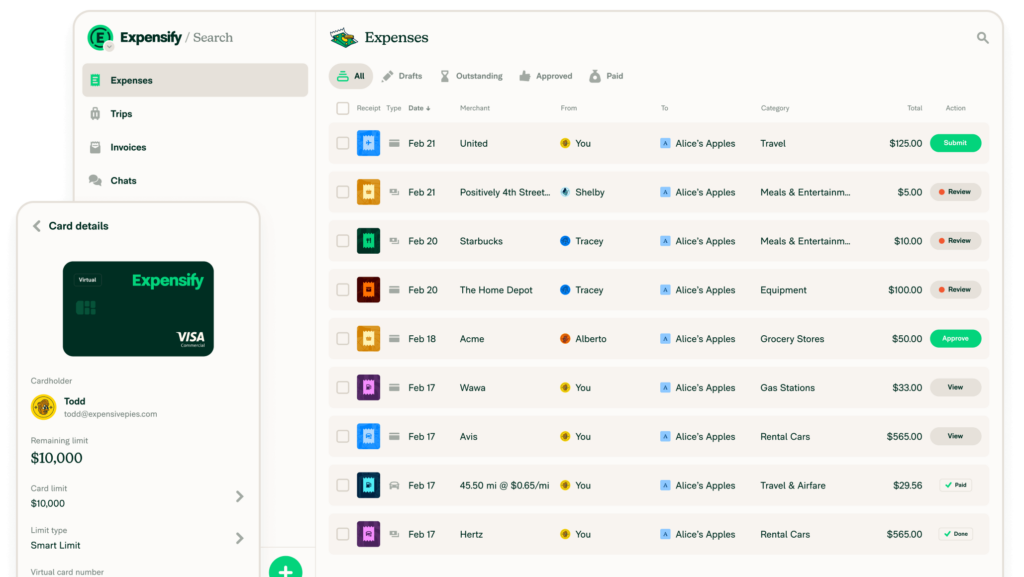

Expensify is the go-to expense management solution that takes the hassle out of tracking receipts, handling reimbursements, and generating expense reports. Free for individual users, it also offers robust paid plans for larger finance teams, delivering a seamless experience for managing business expenses and travel. Expensify transforms expense management from a chore into a smooth, automated process, letting you focus on the bigger picture.

Features:

- Receipt and expense automation

- Real-time reporting and reimbursement

- Mobile app for on-the-go expense management

- Custom categories and tags for budgeting

Pricing: Free for individual users; paid plans for businesses.

Try Expensify

7. Xero

Xero is a widely used cloud-based accounting software offering a free trial, allowing businesses to explore its powerful features. Xero’s tools cover invoicing, payroll, and expense tracking, making it a great choice for businesses with scaling needs that require comprehensive financial oversight.

Features:

- Inventory, payroll, and invoicing capabilities

- Real-time cash flow tracking

- Bank reconciliation for financial accuracy

- Extensive app integrations

Pricing: Free trial available; requires subscription after trial.

Try Xero

8. DataRails

DataRails is a financial planning and analysis platform tailored for businesses aiming to streamline budgeting and forecasting processes. It centralizes data from multiple sources into a single, accessible platform, enabling advanced analytics and reporting. Designed for scalability, DataRails is an excellent choice for companies seeking detailed insights into their financial health.

Features:

- Automates financial reporting and variance analysis

- Centralized dashboard with real-time data

- Advanced budget planning and forecasting tools

- Seamless integration with Excel and other financial systems

Pricing: Custom pricing; free demo available upon request.

9. Causal

Causal is an intuitive business modeling and planning tool that empowers teams to create financial models with interactive dashboards. It simplifies complex planning processes with integrations and visual insights, making it a suitable solution for small teams and startups.

Features:

- Interactive dashboards for real-time modeling

- Integration with accounting tools and data sources

- Granular revenue modeling and KPI tracking

- Intuitive charting and data visualization tools

Pricing: Free for small teams; premium plans start at $250/month.

10. Fathom

Fathom is a versatile financial analysis tool that supports customizable reporting and performance tracking. Its focus on visual insights and integrations makes it a powerful choice for SMBs seeking to optimize financial decision-making.

Features:

- Create custom management reports with charts, tables, and text

- Automated cash flow forecasting with three-way projections (P&L, Balance Sheet, Cash Flow)

- Consolidation for multi-entity businesses

- Benchmark and compare performance across groups or franchises

Pricing: Starts at $40/month per company; free trial available.

Emerging Trends

While the aforementioned tools are designed for current business needs, the financial technology space evolves rapidly. Trends such as blockchain integration, real-time AI data analytics, and fintech-as-a-service models are shaping the future.

Keep an eye on tools that incorporate advanced AI for predictive insights and scenario planning or platforms that leverage blockchain for transaction transparency and security. These features are becoming critical for large-scale financial operations.

Choosing the Right Financial Tool

With plenty of options available, determining which tool aligns with your business goals can be overwhelming. Consider the following when making your decision:

- Scalability: Will this tool serve your future business needs as well as current ones?

- Integration: Can this platform easily integrate with your existing systems like CRM or ERP?

- Ease of Use: Is the software user-friendly for your team?

- Cost Efficiency: Ensure the features you need fit the budget.

Make Your Business Future-Ready

Free financial tools empower CEOs, CFOs, and financial managers to optimize workflows, improve decision-making, and focus on growth opportunities. Whether it’s crafting budgets with PULSE or streamlining payroll through Gusto, these platforms are a window into transformational change.

If you’re ready to elevate your business processes with AI-powered solutions, explore this list of free AI tools tailored for professionals leading the charge toward innovation. Don’t get left behind—embrace the shift.

Similar stories

We are proud to share stories of our open network of entrepreneurs who have used Viceversa’s funding to grow their digital businesses.

Want to save 57 days a year?

2 out of 3 businesses spend about 60 days a year only pitching for and accessing funds*. With Viceversa, you do it in 3.

*Source