Securing the right funds is one of the most significant hurdles entrepreneurs and small business owners face. Whether you’re launching a startup or expanding an existing venture, understanding how to obtain funding is crucial. This guide will explore various funding options, including traditional and alternative methods, to answer the pressing question, “How can I get funding for my business?”

Understanding the Types of Business Funding

1. Venture Capital

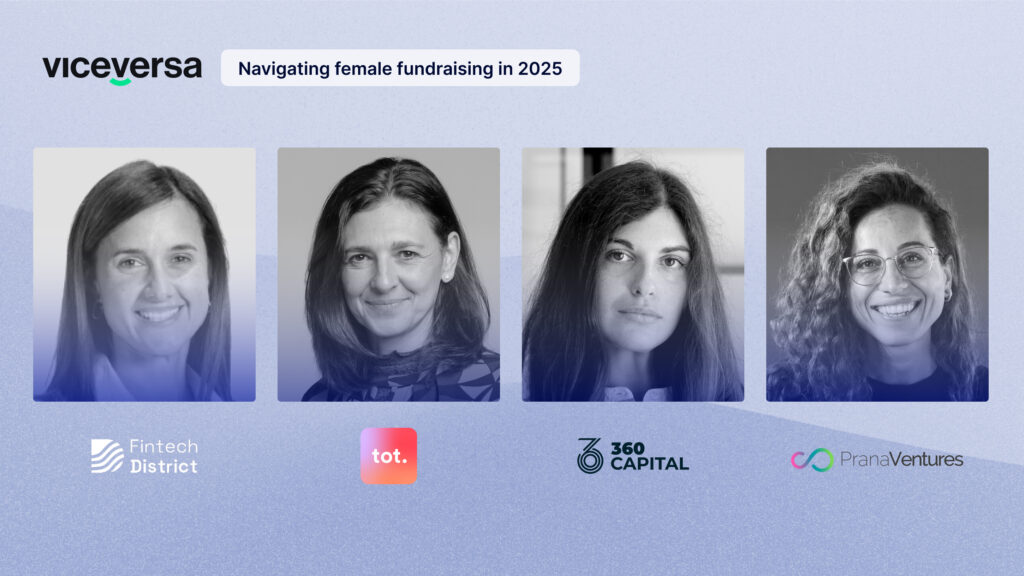

Venture capital involves raising funds from investors who provide capital in exchange for equity stakes in your company. This type of funding is ideal for startups with high growth potential. Venture capitalists not only provide financial support but also bring expertise and industry connections.

2. Angel Investors

Angel investors are affluent individuals who invest their personal funds in startups. They typically seek a higher return on their investment and may offer mentorship opportunities. Angel investors are often more flexible than venture capitalists and may be suitable for early-stage businesses.

3. Small Business Loans

Small business loans are offered by banks and financial institutions to help businesses fund their operations. These loans can be secured or unsecured, with varying interest rates and terms. It’s essential to have a solid business plan and a good credit score to secure a loan.

4. Revenue-Based Financing and other alternative financing

Revenue-based financing (RBF) is a flexible and fast way to raise capital. Companies like Viceversa and others offer funding based on your business’s future revenue. With RBF, you repay a percentage of your revenue, sharing the financial risk. Learn more about RBF in this complete introduction to revenue-based financing.

5. Crowdfunding

Crowdfunding allows you to raise small amounts of money from a large number of people. Platforms like Kickstarter and Indiegogo are popular among startups. Crowdfunding not only provides capital but also validates your product idea and builds a community around your brand.

6. Self-Funding (Bootstrapping)

Bootstrapping involves using personal savings and reinvesting business profits to fund your operations. While it requires discipline and resourcefulness, bootstrapping allows you to maintain full control over your business without giving up equity.

How can I get funding for my business?

Building a Solid Business Plan

A comprehensive business plan is crucial for attracting investors. It should outline your business model, target market, competitive analysis, and financial projections. A well-prepared plan demonstrates your commitment and readiness to potential investors. With RBF, however, less information is needed. You simply connect your data sources securely to the platform, and the AI engine does the rest.

Establishing a Strong Track Record

Investors look for businesses with a proven track record of success. Showcasing past achievements, milestones, and a strong customer base can significantly enhance your credibility. For RBF, only six months of track record are required.

Understanding Personal and Business Credit Scores

Your credit score is a critical factor when applying for loans. Ensure you have a healthy credit history by managing debts responsibly and paying bills on time. Separating personal and business finances can also protect your credit score. While traditional funding options rely on credit scores, RBF does not affect them, offering a distinct advantage to startups and small businesses.

1. How to Approach Potential Investors

Crafting a Compelling Pitch

A compelling pitch tells your business story succinctly. Highlight the problem you’re solving, your unique solution, target market, and growth potential. Practice your delivery and tailor your pitch to different investors. With RBF, all your key information is handled online and you don’t have to perfect a ‘pitch’.

Networking at Industry Events

Industry events and conferences provide opportunities to connect with potential investors. Engage in conversations, exchange business cards, and build relationships that may lead to funding opportunities.

Utilizing Online Platforms for Introductions

Online platforms like LinkedIn and AngelList are valuable for networking with investors. Join relevant groups, participate in discussions, and send personalized connection requests to build your network.

Again, here, RBF is helpful because it doesn’t need any pitch decks, networking or introductions. Your company is valued solely on its revenues and growth activities.

2. Applying for Small Business Loans

Researching and Selecting the Right Lender

Research different lenders and compare their terms, interest rates, and eligibility criteria. Choose a lender that aligns with your business needs and financial goals.

Understanding Loan Options and Requirements

Familiarize yourself with various loan options, such as term loans, lines of credit, and equipment financing. Understand the application process and gather necessary documents, such as financial statements and tax returns.

Preparing a Strong Loan Application

A strong loan application includes a detailed business plan, financial projections, and supporting documents. Clearly articulate how the loan will benefit your business and demonstrate your ability to repay it.

3. The Role of Crowdfunding

Platforms and Their Benefits for Startups

Crowdfunding platforms offer exposure to a broad audience. They allow you to test market demand and create buzz around your product. Choose a platform that aligns with your target audience and funding goals.

Tips for a Successful Crowdfunding Campaign

To run a successful campaign, tell a compelling story, set realistic funding goals, and offer attractive rewards. Promote your campaign through social media and email marketing to reach a wider audience.

4. Self-Funding (Bootstrapping)

Advantages and Disadvantages

Bootstrapping allows you to retain full ownership and control over your business. However, it requires personal financial risk and may limit your growth potential due to limited resources.

Strategies for Maximizing Personal and Business Resources

Optimize cash flow by managing expenses and prioritizing revenue-generating activities. Seek strategic partnerships and leverage free or low-cost tools to stretch your resources.

5. Revenue-Based Financing

How Easy, Fast, and Flexible It Is

Revenue-based financing is a hassle-free option for businesses looking for quick access to funds. You can receive an offer within three days and choose a repayment schedule that aligns with your revenue.

Based on Future Revenues, Sharing the Risk

RBF allows you to repay only when you generate revenue, reducing financial stress during slow periods. This shared-risk model is especially beneficial for seasonal businesses or those experiencing fluctuating sales.

And to conclude…

Securing funding for your business requires perseverance, creativity, and a willingness to explore various options. By understanding the different funding types and preparing thoroughly, you can increase your chances of success. Remember, the question “how can I get funding for my business” has multiple answers—find the one that best aligns with your goals.

Ready to explore revenue-based financing? Get Funded with Viceversa and unlock your business’s growth potential today!

For more insights on financing options like RBF and how they can positively impact your business, be sure to check out our article, RBF vs. Traditional Funding: Which Is Right for Your Scale-up?

Interested to hear more? Check out Viceversa’s growth platform today.

Similar stories

We are proud to share stories of our open network of entrepreneurs who have used Viceversa’s funding to grow their digital businesses.

Want to save 57 days a year?

2 out of 3 businesses spend about 60 days a year only pitching for and accessing funds*. With Viceversa, you do it in 3.

*Source