Fundraising is challenging for any entrepreneur. However, for female founders, the path to securing capital is often steeper, shaped by systemic barriers, gender biases, and historical inequalities that persist in business and funding ecosystems. According to tech.eu, female-founded companies received a meager 2.8% of venture capital funding in 2023 in EU. Despite these obstacles, women continue to make remarkable strides, breaking barriers and building thriving ventures.

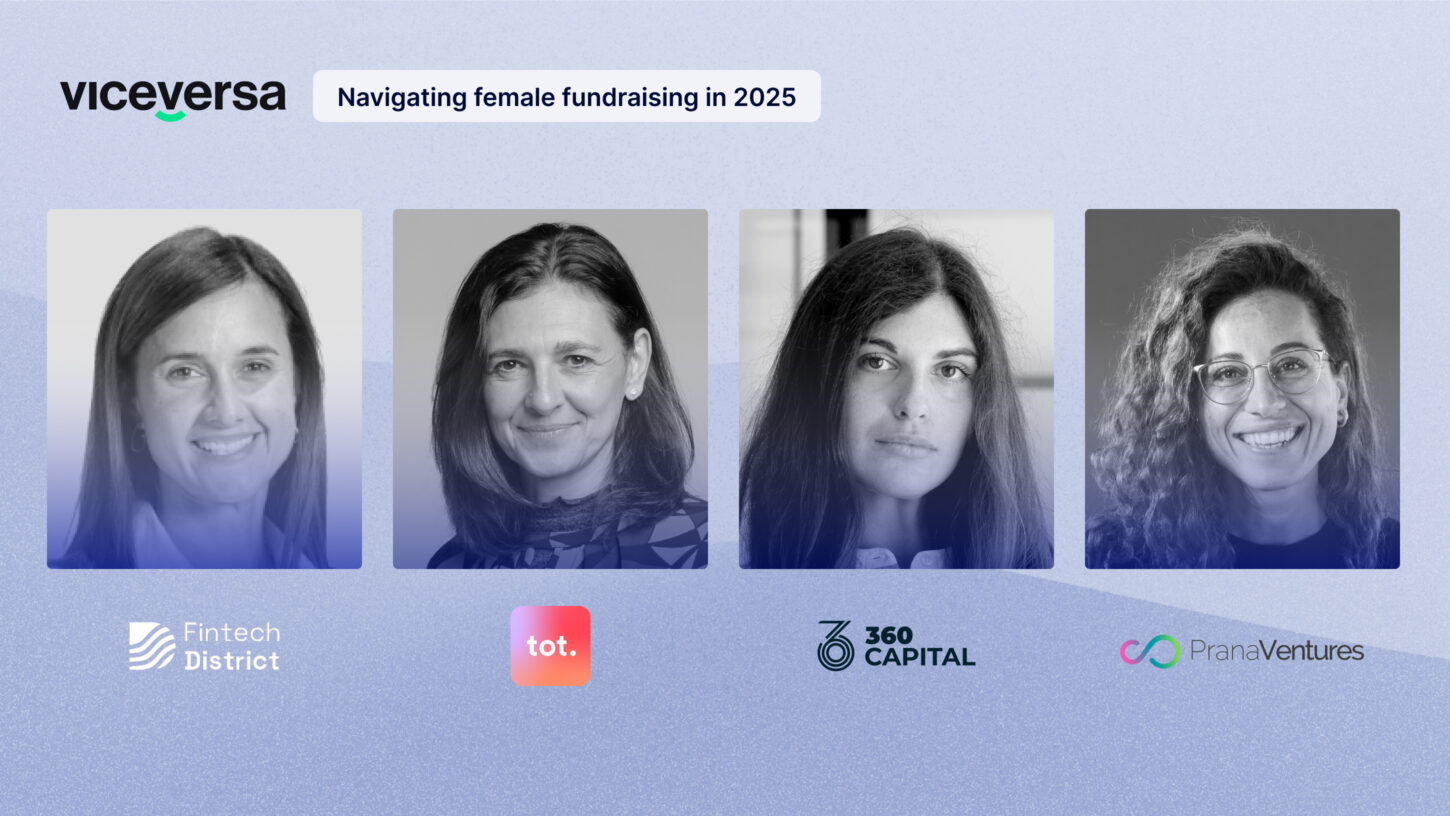

We got in touch with some of the inspiring women leaders in our community to talk about all things fundraising. We explored the key themes women leaders are grappling with during fundraising and some potential solutions to level the playing field.

1. Gender Bias in Investor Confidence

Gender bias remains one of the most significant hurdles for women entrepreneurs. Even today, women leaders often face skepticism from predominantly male investors, who may question their ability to manage finances and lead scaling ventures.

Clelia Tosi, Head of Fintech District, explains, “Women are often confronted with the bias that they lack the skills to manage money, or have less quantitative and management skills, making it harder to justify their leadership to investors who are mostly male.”

This bias not only undermines women-led ventures but also perpetuates a culture of unequal opportunities in funding. However, things are changing and Lucrezia Lucotti, Partner at 360 Capital, contends, “Venture capitalists are still financial investors first and foremost; our job is to try to maximize our returns within a portfolio where outcomes, metrics and potential are considered, regardless of gender.”

The Solution

Lucotti goes on, “I believe that diversity in teams can bring more complementary entrepreneurship, but today, from what we see in the ecosystem, there is no bias for us as investors in evaluating a female founder over a male founder.” Increasing the presence of women on investment committees and venture capital teams could help reduce gender bias and lead to more equitable investment decisions. A more inclusive approach to decision-making, coupled with investor education on unconscious bias, would foster fairer funding processes.

2. Building Strategic Networks with female founders

Building strong, strategic networks is critical for accessing capital. However, many women entrepreneurs face barriers in forming these networks, especially early in their careers. Networks predominantly led by men can make it challenging for women to secure introductions and establish rapport with investors. Lisa Di Sevo, CEO and Managing Partner at PranaVentures, emphasizes, “Women tend to underestimate the importance of building strategic relationships early in their careers. A warm introduction by someone you trust significantly increases the likelihood of being considered seriously.”

The Solution

Entrepreneurs should prioritize networking early on and connect with experienced founders who can share insights or make introductions to investors.

Clelia Tosi adds an interesting point. She says, “We have to learn (we women, first and foremost) that collaborating is better than competing, especially when we talk about innovation and access to capital. Helping each other; measuring ourselves to those who are further along in their careers – to listen to the mistakes they’ve made and avoid repeating them, or to follow paths already taken – is crucial.”

3. Relationship-Building with Investors

Many female founders focus heavily on proving the merits of their ideas but may underestimate the importance of relationship-building with potential investors. Networking is a long-term endeavor. Doris Messina, Co-Founder and CEO of Tot, notes, “Networking has to be cultivated relentlessly, even when you’re not actively raising funds. To make yourself known, initiate, and progress trusting relationships can make investments almost natural later on.”

The Solution

Relationship-building should be approached as a core business strategy, with time allocated to nurture trust within networks. Networking events, industry conferences, and community spaces dedicated to women in business are excellent arenas for strengthening connections. In fact, tech.eu reports that the European Business Angel Network (EBAN) reports that female investors now represent 24% of all angel investors in Europe, an uptick from 20% in 2021.

4. Credit Disparities

Access to credit remains a significant barrier for women-led businesses. Female founders are statistically less likely to be approved for loans or credit compared to their male counterparts. According to Lisa Di Sevo, “Access to credit remains the first barrier to growth for women-led businesses—only 25% are deemed worthy.”

The Solution

Governments and financial institutions can implement policies to close the credit gap, such as offering incentives for lending to women-led businesses or introducing government-backed loan guarantees. Meanwhile, women entrepreneurs can leverage alternative funding options, including equity-free revenue-based financing or crowdfunding platforms.

5. History & Underrepresentation

Representation matters. Historically, women have been underrepresented in entrepreneurship, particularly in male-dominated industries such as technology and finance. This has created a gap in both the number of women-led startups and role models for aspiring female founders. Lucrezia Lucotti explains, “The number of startups led by women is objectively lower due to historical legacies. However, we are seeing growth, especially in tech, where mixed teams bring more nuanced entrepreneurship.”

Di Sevo adds, “It’s not enough to say that women are simply overlooked by venture capital. The low numbers of female entrepreneurs highlight deeper systemic issues that need to change. Consider the gender gap in STEM education — fields that will dominate the market in the next 20 years — where women are still underrepresented.”

The Solution

Address systemic barriers through education and training programs that empower women to pursue fields traditionally dominated by men. Additionally, amplifying success stories of women-led businesses can inspire future generations while demonstrating to investors that women-led ventures present viable, competitive opportunities.

6. The Balancing Act

Many female founders juggle multiple responsibilities, including leading their business, pursuing funding, and managing family life. This “double burden” can make it harder to focus fully on building networks or pitching to investors. Doris Messina adds, “What sets us apart as women is our ability to handle multiple tasks at once—leading a company, nurturing networks for future funding, and caring for our families, especially for those of us with young children.”

The Solution

Create more support systems for working women, including childcare programs and flexible work environments. Additionally, acknowledging and normalizing the demands of parenthood during investor conversations can foster more understanding and inclusive funding discussions and decisions.

7. Lack of Dedicated Resources

While the number of women-led startups is growing, there’s still a significant need for dedicated investors and funds to bridge the gap. Clelia Tosi highlights, “We need funds and programs specifically for women-led companies, alongside diversity incentives in investment teams.”

She continues, “The possible lower appetite for risk that women generally have sometimes leads them to reject investments that may cause uncertainty or loss of even partial control of the company.” This highlights the need for financial education and targeted resources that can provide critical support and build confidence among female founders, a sentiment echoed by Lisa di Sevo.

The Solution

Governments and industries can introduce tax breaks, performance bonuses, or subsidies for investing in women-led ventures. Women-led initiatives and communities also play an essential role. Clelia Tosi notes that things are looking up: “In recent years, we are seeing an exponential growth of associations and initiatives aimed at supporting women in this process.”

8. Importance of Storytelling

Where women leaders historically are considered to be less risk averse, there are other facets that can be leveraged according to Doris Messina. She says, “In the scale-up phase that Tot has entered, a key element is telling its story and presenting itself at its best.” Tot does this via demonstration of their market acceptance, metrics growing in double digits every month, and other indicators that show their ability to scale up.

We, in this case, see that storytelling is a powerful tool in the entrepreneurial journey, particularly for women-led businesses. A compelling narrative can bridge the gap between the market and investors, creating an emotional engagement that goes far beyond numbers and spreadsheets.

Solution

Female founders who craft authentic stories about their vision, challenges, and impact can captivate investors and build stronger connections with their audience. Lucotti highlights, “Fundraising for a startup is nothing more than telling stories that VCs buy and hope to resell tomorrow to other VCs for subsequent rounds or to the future buyer of the company. Having a challenging and consistent narrative of one’s entrepreneurial project is critical to attracting such investors.”

What’s next for female founders?

Fundraising for female founders is riddled with obstacles, but progress is being made. From addressing biases in investor decisions to fostering inclusive networks and building dedicated funds, the entrepreneurial landscape is evolving—albeit slowly. Women leaders, as Doris Messina powerfully states, prove time and again that they can “do it all” while maintaining a healthy balance between their professional and personal lives. Clelia Tosi gives us numbers, “Today there are 30 companies in the Fintech District community with female leadership (meaning they have a female founder currently active in the company in a management role). Although this number represents a small percentage of our community of over 300 companies, it shows a significant increase from just a few years ago.”

For female founders facing these challenges, solutions lie in collaboration, mentorship, and resilience. If you’re a woman-led business navigating the challenges of fundraising, Viceversa is here to support you. We provide flexible, equity-free revenue-based financing tailored to your needs. Get in touch today to take the next steps toward boosting your business with confidence.

Interested to hear more? Check out Viceversa’s growth platform today.

Similar stories

We are proud to share stories of our open network of entrepreneurs who have used Viceversa’s funding to grow their digital businesses.

Want to save 57 days a year?

2 out of 3 businesses spend about 60 days a year only pitching for and accessing funds*. With Viceversa, you do it in 3.

*Source